Market news

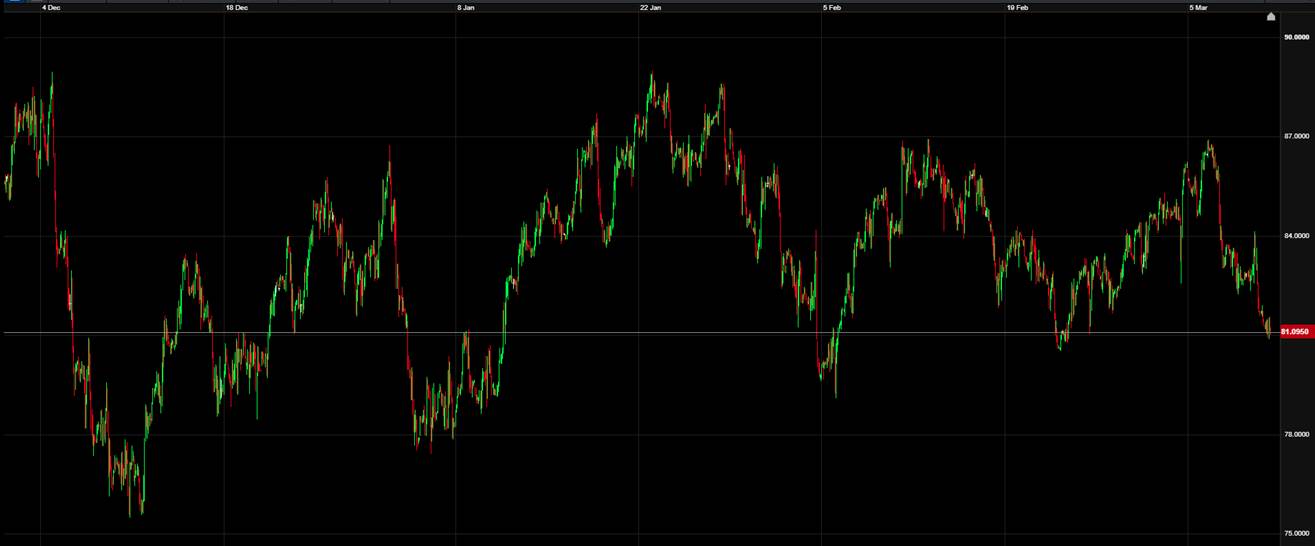

Earlier this week, crude oil prices rebounded more than 2% following a drop to a 15-month low on the previous day, as Credit Suisse’s rescue mitigated worries of a banking crisis that could harm economic growth and reduce fuel consumption.

Efforts to stabilise the banking industry, such as UBS’s acquisition of Credit Suisse and commitments from major central banks to enhance liquidity, have assuaged concerns about the financial system that unsettled markets in the prior week.

Measures to stabilise the banking sector, including a UBS takeover of Credit Suisse and pledges from major central banks to boost liquidity, have calmed fears about the financial system that roiled markets last week.

Today, the banking sell-off continues with the news of sharp increases in the cost of insuring Deutsche Bank’s bonds against the risk of default. This has led to increased volatility in both banking stocks and oil prices.

“A ‘risk back on’ sentiment seems to be coming back to crude, as the latest sell-off may very well have been exaggerated liquidation,” said Dennis Kissler, senior vice president of trading at BOK Financial.

Although prices had initially risen after the Fed’s announcement of a 25-basis-point interest rate hike, they fell after Fed Chair Jerome Powell expressed concerns about credit risks in the U.S. banking system following the recent banking collapses.

OPEC+ also contributed to the bearish sentiment on oil markets by announcing no new production adjustments, likely keeping current quotas until the end of 2023.

According to JP Morgan’s head of global commodity research, Natasha Kaneva, oversupply will continue to pressure oil prices for the next two months, with the market requiring intervention from OPEC+ or the U.S. administration to refill the strategic petroleum reserve to change the outlook.

Industry news

U.S. energy companies reduced the most oil and gas rigs in a month since June 2020, with the gas rig count dropping to the lowest since April.

The oil and gas rig count fell by seven to 753 in the week ending February 24th. Despite the decrease in rigs, the total count was up 103 rigs, or 15.8%, compared to the same period last year. The U.S. oil rig count fell by seven to 600 this week, while gas rigs remained unchanged at 151.

The total oil and gas rig count declined by 18 in February, marking the third consecutive monthly decrease for the first time since July 2020. Oil rigs decreased by nine, while gas rigs also dropped by nine, making it the most significant monthly decline since April 2020. U.S. oil futures have fallen about 5.3% this year after rising around 7% in 2022.

Meanwhile, U.S. gas futures have declined around 45% so far this year after increasing around 20% in 2022. The industry is likely to be impacted by weaker energy prices, which could slow down drilling activity as companies focus on returning money to investors and paying down debt instead of increasing production.

Current hedging price

12-month hedging price – 108.18 pence per litre

(Please contact us for the latest price)

Economic Calendar

29th March: US EIA/DOE Weekly Crude Stocks

30th March: US GDP Final

30th March: EU Consumer Confidence Index