Market Note:

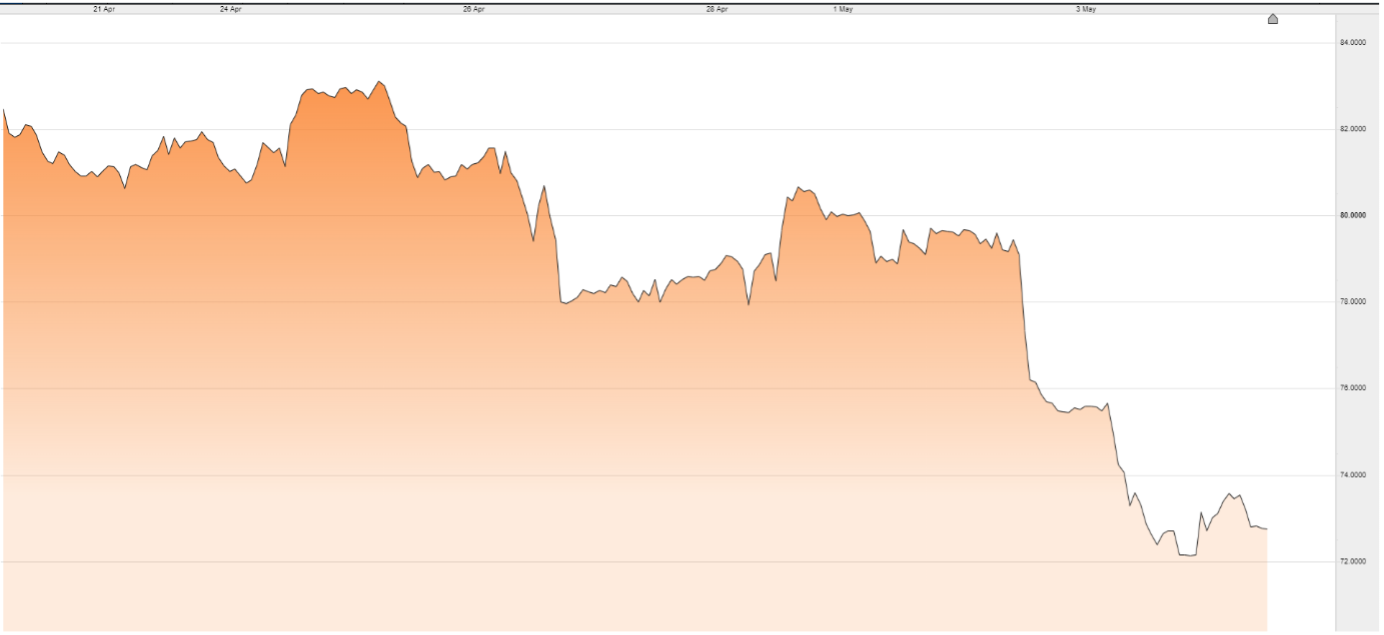

Oil prices have lately lost their forward momentum, with both Brent and WTI crude plunging this week. A rather perplexing trend is being observed in the oil markets: there’s a big disconnect between inventory data and oil prices.

Oil prices crashed in Wednesday’s session, marking the second day of declines ahead of a likely 25-basis point rate hike by the Federal Reserve as well as growing anxiety over the prospect of a recession amid questions about the health of U.S regional banks. WTI June contract slipped 5.1% to $68.29 per barrel while Brent for June settlement was 4.7% lower to $71.80, the lowest level in more than a year.

The current crash closely mirrors the March decline when the banking crisis first unfolded, suggesting the markets are getting concerned about the demand outlook.

Growing fears of a recession due to rising interest rates as well as the risk that Chinese demand could fall short of expectations in the coming months remain a serious overhang on oil prices.

Industry Note:

Diesel ‘rip-off’ as wholesale prices cheaper than petrol for over a month, RAC says.

The motoring group says motorists and businesses are paying well over the odds for diesel and the government must take action to ensure transparency in the market UK-wide. Diesel drivers are being “ripped-off” at the pumps to the tune of around 16p per litre, according to a motoring group.

The RAC, along with others, has long argued that British motorists and businesses are paying over the odds for the fuel – the engine behind the UK economy – fanning the flames of inflation and the cost of living crisis in the process.

It’s believed drivers should be paying around 143p “at the very most” for a litre of diesel. Fuel retailers have long been accused of being quick to raise prices when wholesale costs spike and slow to reduce them to reflect lower costs.