The Market

Oil benchmarks fell significantly last week, roughly 8%, with global economic concerns overcoming any bullish gains expected on account of Chinese demand recovery or the unexpectedly strong US employment data.

Coming into effect on January 5th, the G7 price cap of $100/bbl on Russian exports for Diesel, Gasoline and Jet fuel further stokes volatility. For further products that generally trade at a discount to crude oil, the price cap has been set at $45/bbl. Due to Europe’s reliance on middle distillates from Russia, this market sector is set to feel the squeeze the most.

Last week the OPEC+ group decided to maintain the output levels as per existing agreements and take a more cautious approach to demand recovery, further weighing down on oil prices as the market tightens.

Crude oil stocks in the United States rose last week to their highest since June 2021, helped by higher production, the Energy Information Administration said. The International Energy Agency (IEA) expects half of this year’s global oil demand growth to come from China, adding that jet fuel demand was surging.

Chinese demand was offset by US oil inventories hitting their highest in months and signs the US Federal Reserve could keep raising interest rates.

Friday’s blowout US employment number raised expectations that the Federal Reserve’s rate hikes will not end with a hard economic landing and that the US central bank may have more than one more rate increase left, which could curb economic growth and lower fuel demand.

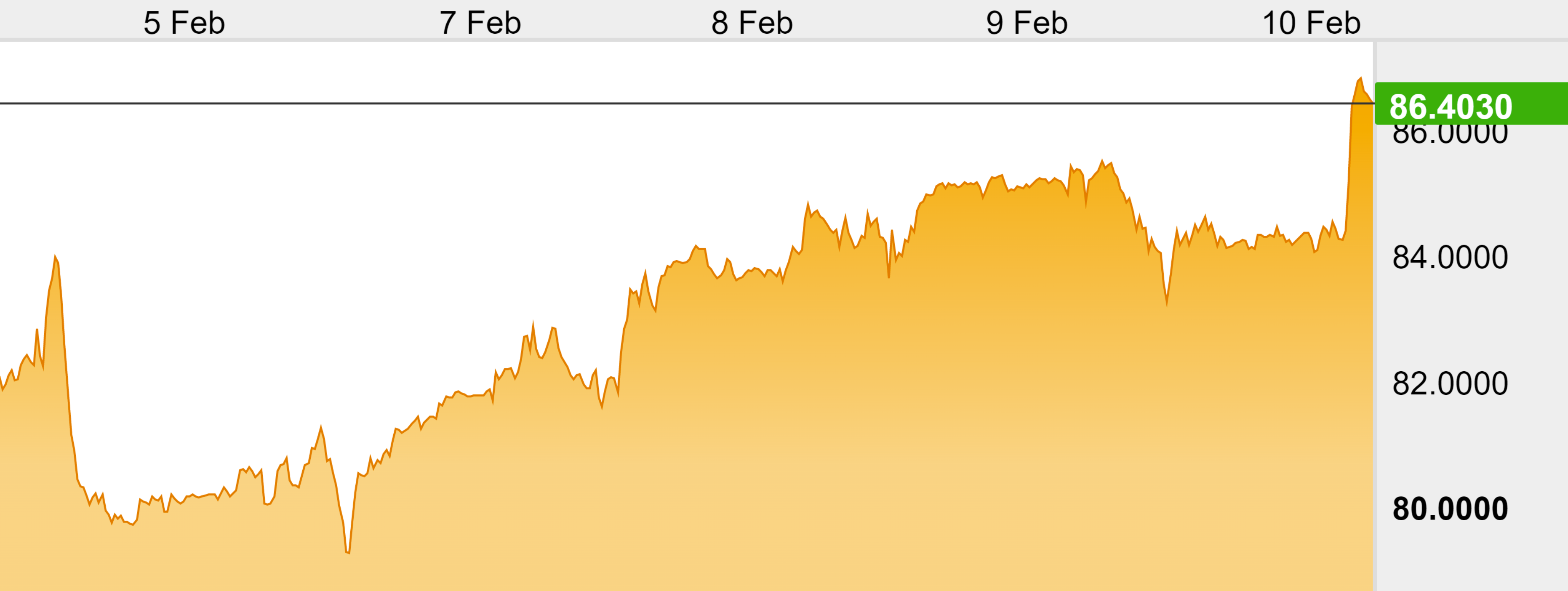

Prices last week recovered on Monday and Tuesday from lows of $75.84, following the price cap agreement on Russian refined products. As of yesterday, Spot Brent Crude was trading at $84.99 USD bbl and WTI Crude at $78.36 bbl.

Industry note:

Financial institutions regularly publish their market forecasts. We have compiled a sample of key names with corresponding Brent predictions (directly representative of the broader data), presented in a summary table. All prices are in USD per barrel ($/bbl). These indicate percentage changes that might be useful when considering possible changes to diesel prices, which are driven by changes in Brent crude oil.

The data collected from a host of thought leaders presents a clear pattern. Today’s crude prices hover around $80/bbl, with a maximum average forecast hitting a 17.25% increase from June 2023. If we translate this to today’s wholesale delivered diesel prices which lie at c.128ppl, we could see a leap to 150ppl this year, a potentially significant move which is bound to have adverse effects on many companies.Across the UK, fuel shortages are facing Jet garages this spring following the ongoing disputes and industrial action over pay disparity from Tanker drivers.

The logistics industry has seen a consistently high demand for storage and warehousing services following a surprisingly prosperous 2020/2021 financial year, with many market leaders expanding into further sites.

Following the proposed 23% increase in Fuel Duty, there are growing industry concerns ahead of the 2023 Spring Budget. Many are fearing a disproportionate increase in fuel duty to inflation and the UK economy, calling for the continued 5ppl cut introduced last March.

This would equate to £4,850 in additional running costs for a 44Ton Truck. With SMEs making up 99% of logistic companies in the UK, freight and haulage businesses with 8 HGVs would be facing an additional £30,000 in costs if it were to go ahead.

Price Movement