A Look Back

The year 2022 has presented a multitude of obstacles due to the continued effects of the Covid-19 pandemic on global markets and the ongoing conflict in Ukraine. Consequences of such a tumultuous year include the energy supply crisis, the fluctuation in commodity prices, the cost-of-living crisis and the onset of recession, which are all inextricably linked.

The world is currently experiencing an unprecedented and complex global energy crisis. Although the pressures in markets existed before Russia’s invasion of Ukraine, Russia’s actions have significantly amplified the impact of the pandemic on global supply chains, including the energy sector. Russia is one of the largest exporters of fossil fuels and its reduction of natural gas supply to Europe, coupled with European sanctions on imports of oil and coal from Russia, is disrupting one of the primary routes of global energy trade. All forms of energy are impacted, but the natural gas market is particularly affected as Russia uses higher energy prices and supply shortages as leverage.

The issue of insufficient investment in the energy sector has been amplified by War in Europe. Consequently, the three elements of a sustainable energy system: energy security, supply diversification and low-carbon transition are now facing a simultaneous set of challenges, creating a trilemma of issues.

Global energy prices increased sharply in 2022. The most pronounced increase was in the price of natural gas. Dutch natural gas futures increased by over 400% to average $16/mmBtu in 2022. Oil prices swung viciously with Brent ending the year around $80/bbl.

The oil and natural gas sector has a history of facing disruptions in supply and fluctuations in prices. In the past seven years, the industry has experienced a range of fluctuations, from highs above $100/bbl in 2014 to lows of -$37/bbl in 2020. However, the current circumstances are exceptional and different from what has been previously encountered in the past.

During 2022 we saw Crude oil move in unprecedented ranges. Crude topped out at c.$130/bbl, early in 2022 but these levels diminished in December to the year lows of c.$77/bbl, this represented a extraordinary range of $53/bbl. The largest increases coming in March with a jump of over 36%.This vast volatility was of grave concern to those who were exposed to oil products. Crude oil closing prices averaged at $103/bbl throughout the year, a 33% increase from 2021. OPEC reluctance to adapt to global demand and favouring a desired level of $90+/bbl in conjunction with supply struggle from Russia caused average prices to sit well above forecasted levels at the beginning of the year.

Gas plays a vital role in the UK’s energy supply, accounting for 44% of the country’s electricity generation in July. The ongoing energy supply crisis highlights the difficulties countries like the UK face as production of oil and gas decreases faster than the demand for it.

The prices for spot purchases of natural gas have reached unprecedented heights, frequently surpassing the equivalent of USD 250 per barrel of oil. Coal prices have also hit all-time highs, and oil prices rose significantly above USD 100 per barrel in mid-2022 before dropping back. These high prices for gas and coal account for 90% of the increase in electricity costs around the globe. To compensate for shortages in Russian gas supply, Europe is planning to import an additional 50 billion cubic meters (bcm) of liquefied natural gas in 2022, compared to the previous year.

Forecasts

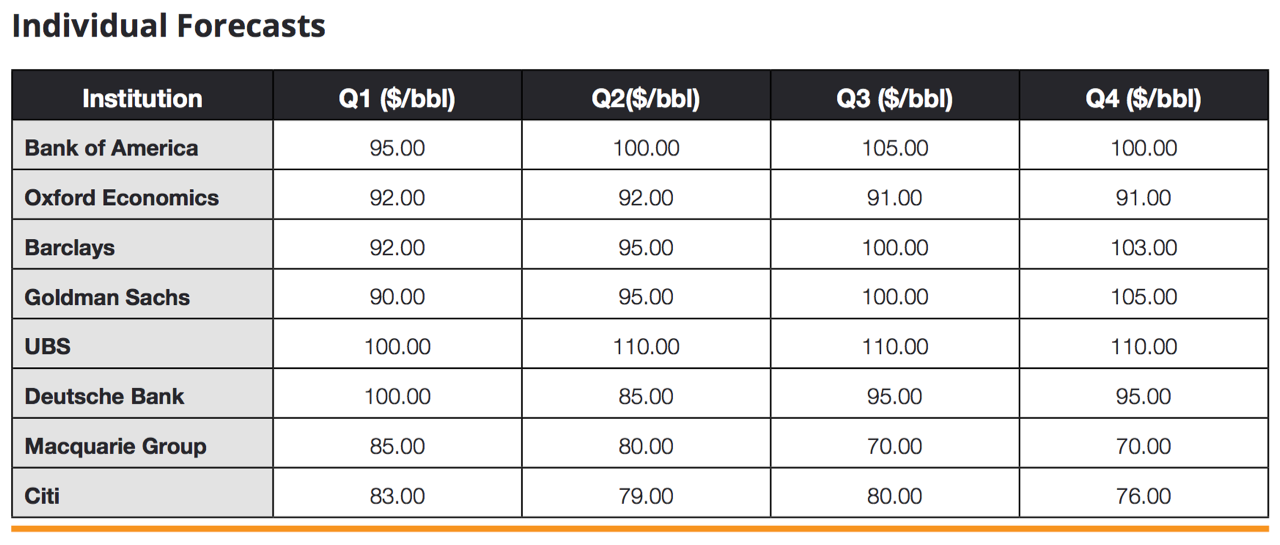

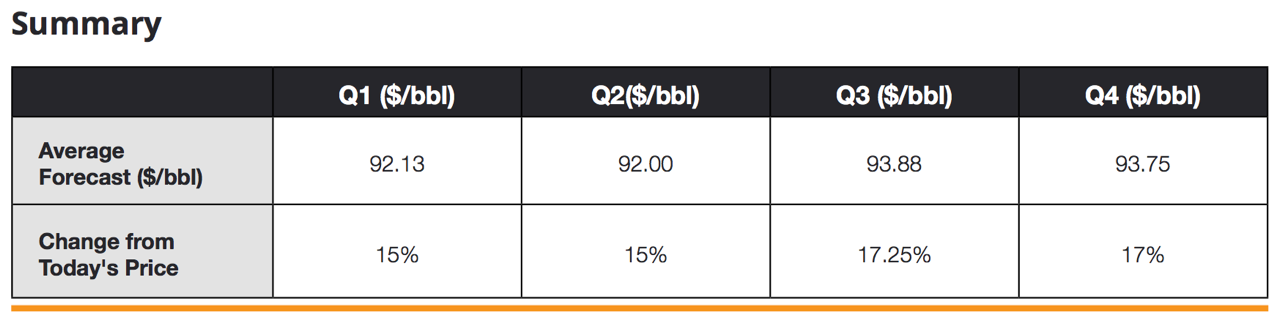

Financial institutions regularly publish their market forecasts. We have compiled a sample of key names with corresponding Brent predictions (directly representative of the broader data), presented in a summary table. All prices are in USD per barrel ($/bbl). These indicate percentage changes that might be useful when considering possible changes to diesel prices, which are driven by changes in Brent crude oil.

The data collected from a host of thought leaders presents a clear pattern. Today’s crude prices hover around $80/bbl, with a maximum average forecast hitting a 17.25% increase from June 2023. If we translate this to today’s wholesale delivered diesel prices which lie at c.128ppl, we could see a leap to 150ppl this year, a potentially significant move which is bound to have adverse effects on many companies.

Forecasts

Demand for Crude rise set to reach a high point in the mid-2030s at 103 mb/d with a very gentle decline to 2050.

The aviation, shipping, and petrochemical industries, as well as heavy trucks, are experiencing an increase in the use of oil globally. These sectors are expected to see a rise in demand of approximately 16 million barrels per day between 2021 and 2050. However, from the mid-2030s, the growth in these sectors will be outweighed by a decline in oil consumption in other areas, particularly in passenger cars, buildings, and power generation.

According to a monthly report from OPEC, world oil demand in 2023 is expected to increase by 2.25 million barrels per day (bpd) or approximately 2.3%. OPEC noted that while global economic uncertainties are significant and growth in key economies remains uncertain, there are also potential positive factors that could offset current and future challenges, such as resolution of geopolitical conflicts in Eastern Europe and an easing of China’s zero-COVID policy.

OPEC forecasts economic growth for 2023 at 2.5%. The report cites the potential easing of China’s COVID policies as one of the possible positive factors that could offset current and future challenges, along with commodity price weakness.

According to the forecast, Brent prices for 2023 are expected to average higher than this year, with a possibility of an upward trend. The expectation for this is partly based on the belief that the Chinese Communist Party will successfully transition away from its strict COVID containment measures, which have been in place for the past three years.

After a period of uncertainty in reopening the economy, it is expected that there will be a decrease in Chinese oil consumption by 500,000 barrels per day in January. However, it is predicted that demand will recover in late first quarter of 2023 and continue to grow throughout the year, resulting in an increase of 700,000 barrels per day of pent-up demand compared to the levels of 2022, as consumers resume travel and increase spending both domestically and internationally.

In Summary the global oil market is predicted to become tighter in 2023 due to a decrease in Russian oil supply and ongoing cuts by OPEC+. This is expected to result in a deficit throughout the year, which suggests that oil prices will likely rise from current levels. An average across all the above data suggests a potential uptick of over 16% on crude prices to c.$92.9/bbl. Inflating prices on all oil-based products consumed in 2023. However, there are potential risks to this projection, such as weaker demand and the potential de-escalation of the Russia-Ukraine war which could impact the supply. Additionally, The US’s potential refilling of its strategic petroleum reserves if WTI falls below $70/bbl could also provide a stable floor to the market.