The Market

Industry commentators predict that oil prices will increase throughout 2023 due to rising demand in China. Data analytics firm Refinitiv has forecasted a Brent crude rise to above $100 per barrel by the end of the year, while others have predicted increases between March and May, a time oil prices usually rise.

This year, crude demand is expected to surge by 2 million barrels per day, with half of that increase coming from China. In addition, a 500,000 bpd cut in Russian crude output will further push prices up. Although market shocks have an immediate effect on prices, the impact of futures shocks takes months to manifest.

Saudi Aramco has increased the prices of its crude oil exports to Asia and Europe for the second month in a row. The cost of Arab Light will go up by $0.50 in April compared to March, while Arab Heavy will experience a bigger increase per barrel of $2.50, changing the crude blend from a discount to a premium. This hike comes as several new refineries in Saudi Arabia will begin operating soon, decreasing the amount of crude available for exports. Although oil prices started the week with a decline, China’s return to normal operations and optimism among oil bulls have prompted the price increases.

According to Shell’s annual report, the former CEO Ben van Beurden earned almost £10 million ($12 million) in salary and bonuses last year after the company recorded record profits due to soaring energy prices. The company’s net profit more than doubled to a record $42.3 billion last year due to Russia’s invasion of Ukraine, which affected the oil supply. The payout has sparked outrage among campaigners, who claim it is a sign of how “broken” the energy system is, given that record profits have been achieved amid a cost-of-living crisis. The record profits for Shell are in correlation to record payouts for executives.

Industry Note

Following a Teletrac Navman survey of more than 1,800 road haulage companies, 39% identified rising fuel costs being the primary concern they currently face, along with supply chain pressure coming out at 31%. “The last 12 months have created new complexities for fleets, but fuel cost rises are the number one concern for operators,” said Alain Samaha, president & CEO of Teletrac Navman.

February saw the average price of a litre of unleaded (pump inc. VAT) come down another penny (1.26p) to 147.72p, while diesel (pump inc. VAT) dropped 3.19p to 167.19p. While the reduction in diesel prices is good news, RAC price data analysts concluded that among the 12m diesel vehicles, UK consumers continue to pay questionably high prices.

Commercial consumers face a ‘pump price shock’ next week unless the Chancellor decides to maintain the 5p duty cut and cancel the planned hike in the Spring Budget. If the duty cut is removed as planned, analysts suggest unleaded would rise to 153.72p and white diesel to 173.19p when factoring in VAT.

To put today’s prices, concerning the Chancellor’s imminent decision on fuel duty, into context, average wholesale diesel prices are extremely similar to where they were a year ago (122.76p at the end of February 2022, 119.09p at the end of last month), presenting a unique position to secure rates for 2023.

Price Movement

12-month hedging price – 112.14ppl

GBP EUR – 1.1309

GBP USD – 1.1981

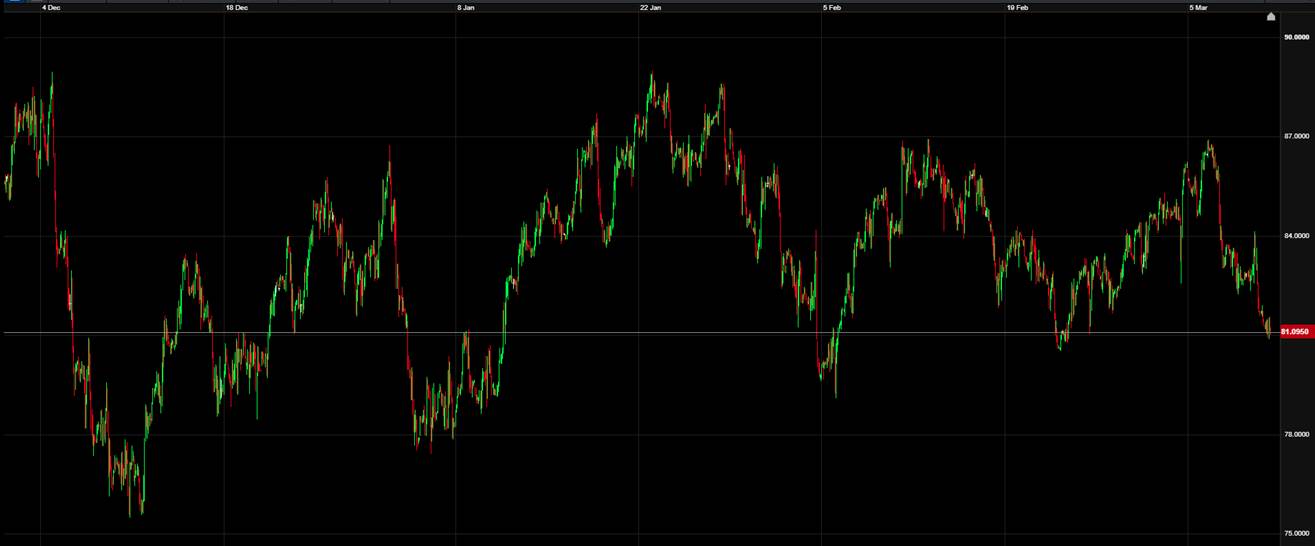

Brent Crude Oil Price –

Economic Calendar

Tuesday 14th March – US Inflation – CPI MoM

Wednesday 15th March – Chinese Retail Sales

Thursday 16th March – US Housing Starts – MoM