The Market

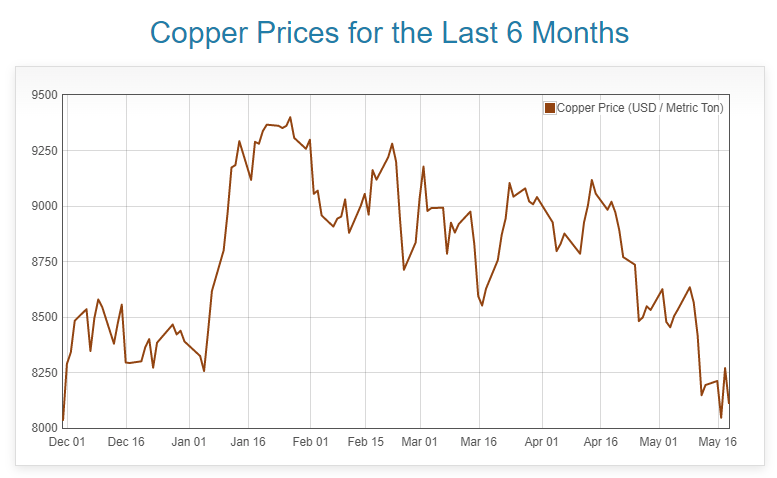

This past Wednesday, the copper market tumbled, hitting a startling 5-and-a-half-month low. An amalgamation of factors pushed the value of this versatile metal down, with the declining demand from China—a global powerhouse in copper consumption—being the primary culprit. Contributing to this copper market slump were the ever-increasing stockpiles in the London Metal Exchange’s (LME) approved warehouses, as well as the robust American dollar applying additional downward pressure.

Yet, in the face of these challenges, copper managed to rally. Benchmark copper on the LME experienced a slight yet noteworthy uptick of 1.2%, ending the trading session at $8,200 per tonne at 0955 GMT. This surge happened despite copper stocks in LME warehouses skyrocketing by 70% over the last month, reaching the highest level since January at 86,625 tonnes.

Market pundits are speculating that the cycle of interest rate hikes by the US Federal Reserve is nearing its final lap, characterizing the latest rate hike in May as dovish in light of economic downturns. This could result in the US dollar embarking on a bearish journey, possibly providing a lifeline for copper prices.

China’s release of its first-quarter macro-economic data didn’t particularly ruffle the copper market. However, the LME copper market displayed clear signs of a wave of long liquidation, as shown by the paradox in open interest. This suggests that the recent burst of Chinese macro data may serve as a catalyst for a boost in copper prices in the forthcoming months.

Copper smelting wasn’t spared from troubles either, adding more strain to the already stretched supply. Data from Earth-i shows that global smelting activity for April plunged to its lowest point since March 2021, suggesting continued contraction.

In the aluminium arena, the spotlight was on the considerable holding of LME warrants, with the three-month aluminium premium jumping to an impressive $11.30 per tonne on Tuesday—a level not seen since mid-April.

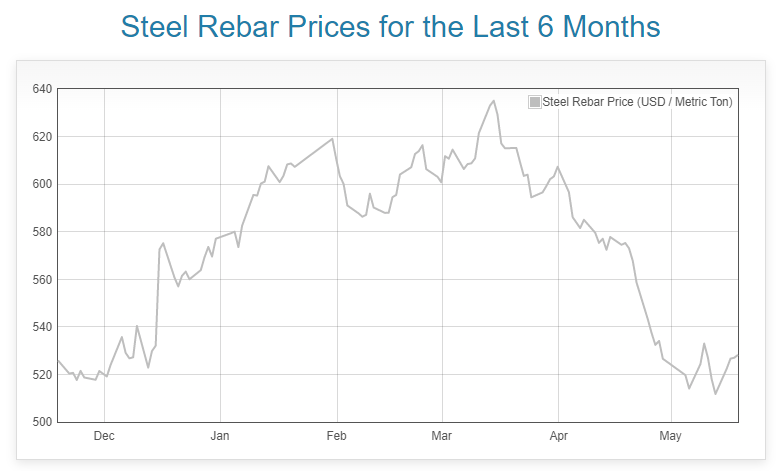

Over in China, steel production ramped up significantly in Q1, producing an overwhelming 262 million tons of steel. Yet, the demand hasn’t matched this spike. Conversely, in the UK, the combination of sky-high energy costs and dwindling demand dealt a significant blow to steel production, leading to the lowest production level since the Great Depression—a 17% reduction year-on-year, totaling a mere 6 million tonnes.

Inventory management also witnessed a significant pivot recently. In late April, the focus was on inventory maintenance; however, the trend has now shifted towards stock reduction, signaling a change in strategy.

Rising iron ore prices, compounded with economic uncertainty in Europe for 2023, continue to disrupt trade. The benchmark 63.5% Fe price sat at $103 per metric ton CFR Tianjin on May 11, showing a sharp 23.4% drop from its peak of $134.50 earlier this year in March.

Finally, in the broader metals market, this week saw some gains. Zinc rose by 1.7% to $2,527, lead increased by 0.9% to $2,064, tin ascended by 1.3% to $24,840, and nickel also made some strides.